Drop Shipping Passive Income: 7 Proven Strategies for Financial Freedom

Are you looking for ways to make passive income? Drop shipping might just be the perfect solution for you. This method allows you to sell products online without ever needing to hold any inventory, making it a great way to earn money while you sleep. Many people are realising the benefits of passive income and exploring ideas like this to build financial freedom.

There are countless passive income investments available today. You can consider options like rental properties, dividend stocks, or even creating digital products. Each of these ideas comes with its own set of advantages and challenges, but they all share the potential to generate income over time with minimal ongoing effort. The best ways to make passive income typically involve some initial investment of time or money but can pay off significantly if done wisely.

Getting started with drop shipping or other passive income ventures requires careful planning and research. Whether you’re looking to supplement your income or create a full-fledged business, diving into these opportunities can lead to exciting financial growth. The key is to find what aligns best with your skills and interests and to keep learning as you go.

Table of Contents

The Foundations of Passive Income

Building a solid understanding of passive income is essential for anyone looking to earn money with minimal day-to-day effort. Key aspects include what passive income truly involves, the necessary active effort to establish it, and how to evaluate potential risks and rewards.

Understanding Passive Income

Passive income refers to earnings you receive with little ongoing effort. Common sources include rental income, dividends from investments, and royalties from creative works. This type of income allows you to earn while you sleep, giving you financial freedom.

To create passive income, you must first invest time or money into a project. For instance, starting a blog may require extensive writing initially. Once established, it can generate ad revenue or affiliate sales without much ongoing effort on your part.

It’s also vital to identify passive income ideas that align with your interests and expertise. This could include creating an online course, investing in real estate, or designing an app. Finding the right niche can make a huge difference in your success.

The Role of Active Effort in Passive Income

While the goal of passive income is to earn without much ongoing work, initial active effort is crucial. The more time and effort you invest upfront, the greater your potential returns can be in the long run.

For example, if you choose to drop ship products, you’ll need to spend time setting up your online store, researching suppliers, and managing customer service initially. Over time, these tasks can become manageable, but dedication is essential at the start.

Additionally, building passive income streams often requires ongoing learning. Staying updated on market trends or new strategies is key to ensuring sustained success. Active involvement can protect your investments and help you adapt to changes in demand or competition.

Assessing Risk Versus Reward

Every passive income venture has its risks and rewards. Understanding these elements is vital for making informed decisions.

For example, real estate can provide excellent returns, but it requires capital investment and carries risks like property damage or market fluctuations. Evaluating your risk appetite will help you choose the right opportunities.

You might also consider diversifying your passive income sources. By spreading your investments across different areas—such as stocks, real estate, or digital products—you can reduce potential losses. Weighing each option’s risk against its potential reward is crucial for building a solid passive income portfolio.

E-commerce and Drop Shipping Passive Income

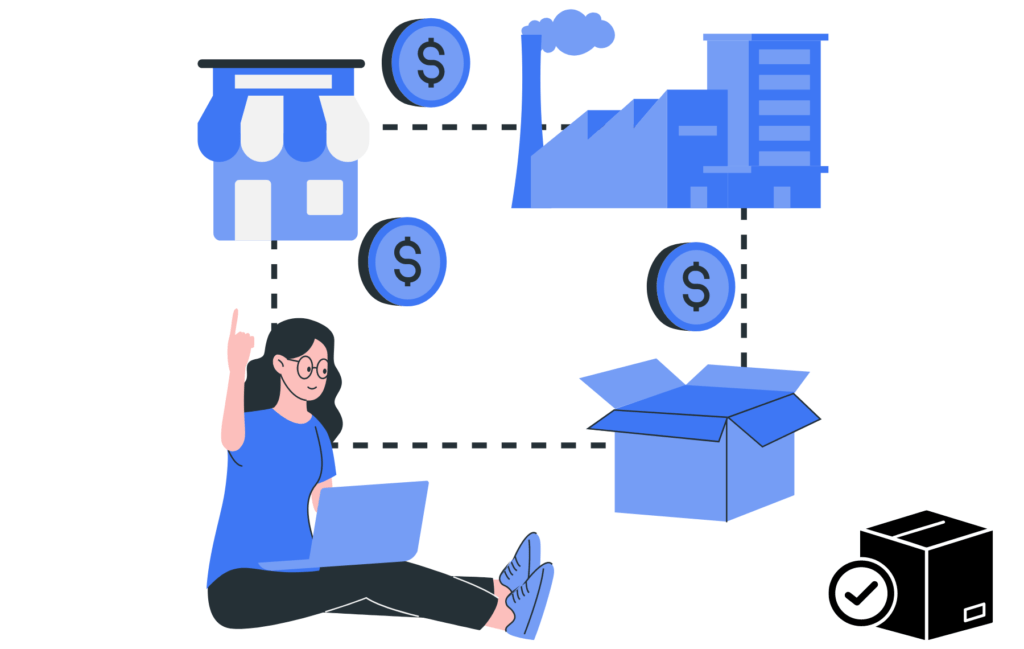

Setting up an online drop shipping business can allow you to earn passive income. This model requires little upfront investment since you don’t need to hold stock. Instead, suppliers ship products directly to your customers once you make a sale.

Setting Up an Online Drop Shipping Business

To start, you need to choose a product niche that interests you. This could be anything from eco-friendly products to tech gadgets. Research your target market to understand the demand.

Next, select a reliable drop shipping platform. Popular choices include Shopify and WooCommerce. Both offer user-friendly tools to build your store.

After setting up your online store, connect with drop shipping suppliers. Websites like AliExpress or SaleHoo can help you find quality suppliers. Make sure to review their delivery times and product quality before partnering.

Maximising Revenue through Online Platforms

Once your store is ready, think about marketing strategies. Utilise social media platforms like Instagram and Facebook to reach potential customers. Create engaging content that showcases your products.

Email marketing can also boost sales. Build a subscriber list and send regular updates about new products or special offers. Consider running paid ads to increase visibility and attract more buyers.

Maintaining good customer service is key. Respond promptly to inquiries and handle complaints professionally. Happy customers are likely to return and refer others, increasing your revenue.

Challenges of Drop Shipping

While drop shipping can be a great way to earn passive income online, there are challenges. You may face tough competition, as many entrepreneurs enter this space. Standing out requires unique products or superior customer service.

Shipping issues can also arise. Customers expect quick delivery, but suppliers might have delays. Regularly communicate with your suppliers to avoid these problems.

Moreover, profit margins can be thin. Ensure your pricing covers all costs like shipping and platform fees. Regularly review your expenses and adjust your prices as needed to keep your business profitable.

Drop Shipping Passive Income: 7 Proven Strategies for Financial Freedom

Here are seven proven strategies to help you generate passive income through drop shipping and set yourself on the path to financial independence.

1. Identify a Profitable Niche

The foundation of a successful drop shipping business starts with choosing the right niche. Look for a market that you’re passionate about and has a demand for products. Conduct thorough research using tools like Google Trends, social media insights, and keyword analysis to identify trending products. Remember, “Find a need and fill it!” By focusing on a niche with both high demand and manageable competition, you can position yourself for success.

2. Partner with Reliable Suppliers

Your suppliers are crucial to your drop shipping success. Partnering with reliable suppliers ensures that you receive quality products and timely shipping. Platforms like AliExpress, Oberlo, and Spocket can connect you with trustworthy suppliers. Look for those with positive reviews and good customer service. As the saying goes, “You’re only as strong as your weakest link,” so choose your partners wisely!

3. Build a Professional Online Store

Your online store is your digital storefront, and it should reflect professionalism and trustworthiness. Use platforms like Shopify or WooCommerce to create a user-friendly website that showcases your products effectively. Invest time in crafting appealing product descriptions, using high-quality images, and ensuring easy navigation. A well-designed store can significantly impact conversion rates. Remember, “First impressions count!”

4. Optimize for Search Engines (SEO)

To attract organic traffic, optimizing your online store for search engines is essential. Incorporate relevant keywords into your product titles, descriptions, and blog content. This helps improve your visibility on search engines like Google. Additionally, consider creating valuable content related to your niche, such as blog posts or guides, to enhance your SEO strategy.

5. Utilize Social Media Marketing

Social media is a powerful tool for promoting your drop shipping business. Platforms like Instagram, Facebook, and Pinterest can help you connect with potential customers. Share engaging content, showcase your products, and interact with your audience to build a loyal following. Running targeted ads can also increase your reach and drive traffic to your store.

6. Provide Exceptional Customer Service

Outstanding customer service can set you apart from your competitors. Respond promptly to inquiries, address concerns, and ensure a smooth shopping experience. Happy customers are more likely to leave positive reviews and recommend your store to others. Implementing a clear return policy and providing tracking information can also enhance customer satisfaction.

7. Analyze and Adapt

Finally, always be willing to analyze your performance and make necessary adjustments. Use analytics tools to track your sales, website traffic, and customer behavior. Identify which products are performing well and which aren’t, and refine your marketing strategies accordingly. Staying flexible and adapting to market changes is key to long-term success.

Investment Opportunities for Passive Income

When looking to build passive income, certain investment avenues stand out. Each option offers unique advantages, allowing you to earn money while you focus on other interests. Let’s explore some of the best opportunities available.

Real Estate and REIT Investing

Investing in real estate can be a lucrative source of passive income. You can buy rental properties to earn monthly rent. This method gives you control, but it requires management.

If you’re not ready for the hands-on approach, consider Real Estate Investment Trusts (REITs). REITs allow you to invest in real estate without owning property directly. They pay dividends, providing a steady income stream. You can invest in residential or commercial REITs, depending on your interests.

Both options can share benefits such as appreciation and cash flow, making them great for building wealth over time. Just remember to research the market before diving in.

Stock Market and Dividend Stocks

Investing in the stock market is another exciting way to generate passive income. Focus on dividend stocks, which pay you a portion of the company’s earnings. These can be a reliable source of income, especially if you reinvest dividends to purchase more shares.

Consider creating a diversified portfolio of dividend-paying stocks. This reduces risk while increasing potential returns. Look for companies with a strong history of increasing their dividends over time.

You can also explore exchange-traded funds (ETFs) that focus on dividend stocks. These funds offer the benefits of diversification and can simplify your investment process.

Peer-to-Peer Lending and Bonds

Peer-to-peer (P2P) lending is gaining popularity for generating passive income. In this model, you lend money directly to individuals or businesses in exchange for interest payments.

P2P lending can offer higher returns than traditional savings accounts or bonds. However, keep in mind that there are risks involved, including default. Research platforms to find reputable ones with good track records.

Bonds can also be a stable income source. They typically provide fixed interest payments. Look for government or corporate bonds that align with your risk tolerance and income goals. Both P2P lending and bonds can add variety to your income strategy.

Optimising Passive Income Streams

To truly benefit from passive income, managing your resources wisely is essential. You need to diversify your sources and adopt best practices for sustaining your earnings. Additionally, scaling your income can take your efforts to new heights.

Managing and Diversifying Income Sources

Start by identifying various passive income streams. This could include assets like rental properties, dividend stocks, or an online store. Diversification is key. You wouldn’t want to rely on just one source.

Consider using platforms like Affiliate Marketing or dropshipping, where you can automate much of the sales process. This way, if one source dips, others can balance out the income.

Monitor your streams regularly to ensure they remain profitable. Adjusting your strategies as needed can help maintain a steady flow, making it crucial to stay engaged with your investments.

Best Practices for Sustainable Income

To keep your passive income going, develop routines that promote sustainability. First, set clear financial goals. This anchors your efforts and gives you something to strive for.

Next, reinvest your earnings to grow your income. For instance, putting profits from a dropshipping business into a high-yield savings account can amplify returns over time.

Utilise tools like budgeting apps to track your income. This helps you understand your cash flows better and make informed decisions on future investments. Stay patient; building passive income is often a marathon, not a sprint.

Strategies for Scaling Passive Earnings

Scaling your income involves smart strategies that push your earnings even further. One effective method is automation. Use software to manage inventory, emails, or financials in dropshipping.

Explore digital products or courses. These can generate sales without ongoing time investment. Once created, they continue to sell with little effort.

Finally, consider partnerships or collaborations. Aligning with others in your niche can broaden your audience. This means more potential sales and income growth, letting you enjoy the benefits of your hard work.

Frequently Asked Questions

How can one generate passive income with minimal initial investment?

You can begin with a blog or a YouTube channel. These platforms allow you to create content that can earn money through ads or sponsorships. Another option is affiliate marketing, where you earn a commission by promoting other people’s products.

What are the best strategies for beginners to establish a passive income stream?

Start by researching different methods. Consider things like investing in dividend stocks or real estate crowdfunding. These can provide regular returns without needing a large upfront investment.

What are some intelligent approaches to earning passive income?

Consider setting up automated income streams. This might include using apps that round up your purchases and invest the spare change. Another smart move is to reinvest dividends to grow your earnings over time.

What passive income opportunities are well-suited for young adults?

Young adults can benefit from online gigs like blogging or podcasting. These require little upfront cost and can lead to long-term earnings. Additionally, investing in stocks or cryptocurrency can be a good fit, as these can grow with time.