Stocks That Pay Dividends: Top Picks for Reliable Income

If you’re looking to invest in stocks, you may want to consider stocks that pay dividends. A dividend is a portion of a company’s profits that is paid out to shareholders. By investing in dividend-paying stocks, you can earn a regular income stream from your investments.

Dividend-paying stocks are popular among investors who are looking for a reliable source of income. They can provide a steady stream of cash flow, which can be especially useful for those who are retired or who are looking to supplement their income. Additionally, dividend-paying stocks can offer a degree of stability, as companies that pay dividends tend to be more established and financially sound.

However, it’s important to note that not all dividend-paying stocks are created equal, and it’s important to do your research before investing in any particular company.

According to Statista, From January to September 2023, the Shanghai Stock Exchange raised the most money globally through initial public offerings (IPOs), getting 26.2 billion U.S. dollars. The Shenzhen Stock Exchange came in second place, raising 19 billion U.S. dollars from IPOs during the same period.

Understanding Dividend Stocks

If you are looking to invest in stocks, you may have heard of dividend stocks. These are stocks that pay a portion of their profits to shareholders on a regular basis. In this section, we will cover everything you need to know about dividend stocks.

How Do Dividend Stocks Work?

When a company earns a profit, it has a few options for what to do with that money. It can reinvest the profits back into the business, pay off debt, or pay a portion of the profits to shareholders in the form of dividends. Dividend stocks are stocks that pay a regular dividend to shareholders.

Advantages and Disadvantages of Dividend Stocks

One advantage of dividend stocks is that they can provide a steady stream of income for investors. This can be especially appealing for retirees or those looking to supplement their income. Additionally, dividend stocks can be less volatile than other types of stocks, as companies that pay dividends tend to be more established and financially stable.

However, there are also some disadvantages to dividend stocks. For example, companies that pay dividends may not have as much money to reinvest in the business, which can limit their growth potential. Additionally, the dividend yield (the amount of dividend paid per share divided by the share price) can fluctuate over time, which can make it difficult to predict the income you will receive from your investment.

Top Stocks to Buy

If you are interested in investing in dividend stocks, there are many options to choose from. Some of the top stocks to buy for dividend income include Royal Dutch Shell, British American Tobacco, and Unilever. These companies have a history of paying consistent dividends and are considered to be financially stable.

Dividend stocks can be a good option for investors looking for a steady income stream. However, it is important to carefully consider the advantages and disadvantages of these types of stocks before investing. Additionally, it is important to do your research and choose stocks that are financially stable and have a history of paying consistent dividends.

Benefits of Dividend-Paying Stocks

If you’re looking for a reliable source of income from your investments, dividend-paying stocks can be a great option. Here are some benefits of investing in dividend-paying stocks:

Stable Income Stream

Dividend-paying stocks provide a stable stream of income that can help you achieve your financial goals. By investing in companies with a history of paying dividends, you can receive regular payments that can supplement your income or help you save for the future.

When you invest in dividend-paying stocks, you can also benefit from the power of compounding. By reinvesting your dividends, you can buy more shares in the company, which can increase your future dividend payments.

Reinvestment Opportunities

Dividend-paying stocks can also provide opportunities for reinvestment. If you choose to reinvest your dividends, you can buy additional shares in the company, which can help you grow your investment over time.

Reinvesting your dividends can also help you take advantage of market fluctuations. When the price of a stock is low, you can buy more shares with your dividend payments. When the price of a stock is high, you can hold onto your dividend payments and wait for a better buying opportunity.

Overall, dividend-paying stocks can be a great way to generate income and build wealth over the long term. By investing in companies with a history of paying dividends, you can benefit from a stable income stream and opportunities for reinvestment.

Evaluating Dividend Stocks

When evaluating dividend stocks, there are a few key factors that you should consider. In this section, we will explore the three main aspects of evaluating dividend stocks: dividend yield, payout ratio, and company financial health.

Dividend Yield

The dividend yield is the annual dividend payment divided by the current stock price, expressed as a percentage. It is a quick way to determine the return on your investment. A higher yield generally indicates a better return, but it is important to consider the company’s financial health and future prospects.

Payout Ratio

The payout ratio is the percentage of earnings paid out as dividends. A lower payout ratio indicates that the company is retaining more earnings for reinvestment, while a higher payout ratio indicates that the company is returning more earnings to shareholders. However, a very high payout ratio may be unsustainable in the long term, as the company may not have enough earnings to fund future growth.

Company Financial Health

It is important to evaluate the financial health of the company before investing in dividend stocks. Look for companies with a strong balance sheet, low debt levels, and consistent earnings growth. You can also look at the company’s dividend history to see if they have a track record of paying and increasing dividends over time.

In summary, evaluating dividend stocks involves considering the dividend yield, payout ratio, and company financial health. By taking these factors into account, you can make informed investment decisions and potentially earn a steady stream of income from your investments.

Top Dividend Stocks to Consider

If you are looking for stocks that pay dividends, there are many options to choose from. Here are some top dividend stocks to consider:

1. Unilever

Unilever is a British-Dutch multinational consumer goods company that owns over 400 brands, including Dove, Lipton, and Ben & Jerry’s. Unilever has a long history of paying dividends and is considered a reliable dividend stock. In 2023, Unilever paid a dividend of £1.55 per share, which represents a yield of 3.4%.

2. GlaxoSmithKline

GlaxoSmithKline is a British multinational pharmaceutical company that develops and produces vaccines, prescription medicines, and consumer health products. GlaxoSmithKline has a strong track record of paying dividends and is considered a safe dividend stock. In 2023, GlaxoSmithKline paid a dividend of £0.80 per share, which represents a yield of 5.4%.

3. BP

BP is a British multinational oil and gas company that operates in over 70 countries worldwide. BP is known for paying high dividends and is considered a top dividend stock. In 2023, BP paid a dividend of £0.35 per share, which represents a yield of 7.2%.

4. Royal Dutch Shell

Royal Dutch Shell is a British-Dutch multinational oil and gas company that operates in over 70 countries worldwide. Royal Dutch Shell is known for paying high dividends and is considered a top dividend stock. In 2023, Royal Dutch Shell paid a dividend of £0.43 per share, which represents a yield of 5.6%.

5. Vodafone

Vodafone is a British multinational telecommunications company that operates in over 25 countries worldwide. Vodafone is known for paying high dividends and is considered a top dividend stock. In 2023, Vodafone paid a dividend of £0.09 per share, which represents a yield of 6.1%.

These are just a few examples of top dividend stocks to consider. When choosing dividend stocks, it is important to consider factors such as the company’s financial health, dividend history, and dividend yield. Keep in mind that past performance is not a guarantee of future results, and it is always important to do your own research before investing.

Dividend Stocks in Emerging Markets

If you’re looking for high dividend yield stocks, emerging markets could be a good place to start. Many companies in these markets pay out a significant portion of their earnings in dividends. In addition, emerging markets have the potential for long-term growth, which can lead to capital appreciation.

One company to consider is China Petroleum & Chemical Corporation (Sinopec). Sinopec is one of the largest oil and gas companies in China and has a dividend yield of around 7%. The company has a strong balance sheet and is well-positioned to benefit from the growth in China’s energy demand.

Another option is Taiwan Semiconductor Manufacturing Company (TSMC). TSMC is the world’s largest semiconductor foundry and has a dividend yield of around 3%. The company has a strong competitive position and is well-positioned to benefit from the growth in the semiconductor industry.

If you’re looking for a more diversified option, consider iShares MSCI Emerging Markets ETF (EEM). This ETF tracks the performance of emerging market stocks and has a dividend yield of around 2%. The ETF provides exposure to a wide range of companies in emerging markets and can be a good option for investors who want to diversify their portfolio.

Keep in mind that investing in emerging markets can be riskier than investing in developed markets. These markets can be more volatile and may be subject to political and economic instability. It’s important to do your research and consider your risk tolerance before investing.

Overall, dividend stocks in emerging markets can be a good option for investors who are looking for high dividend yields and long-term growth potential. Just be sure to do your due diligence and consider the risks involved.

Strategies for Investing in Dividend Stocks

When it comes to investing in dividend stocks, there are a few different strategies you can use. Here are two of the most popular:

Dividend Growth Investing

Dividend growth investing is a strategy involving investing in companies with a history of increasing their dividends over time. These companies may not necessarily have the highest dividend yields, but they have a strong track record of increasing their dividends, which can lead to significant long-term returns.

To identify companies that are good candidates for dividend growth investing, you can look at their dividend history, financial statements, and other key metrics such as earnings growth and payout ratios. Dividend growth investing requires patience and a long-term outlook, as it can take years for a company’s dividend payments to grow significantly.

High-Yield Dividend Investing

On the other hand, high-yield dividend investing is a strategy that involves investing in companies with the highest dividend yields. These companies may not necessarily have a long history of increasing their dividends, but they offer high dividend payouts relative to their stock price.

While high-yield dividend stocks can provide attractive income streams but also have higher risks. Companies that offer high dividend yields may be struggling financially or may not have sustainable business models. As such, it’s important to do your due diligence and carefully evaluate the financial health of any high-yield dividend stocks you’re considering.

Ultimately, the best strategy for investing in dividend stocks will depend on your individual goals, risk tolerance, and investment horizon. By carefully evaluating the financial health and dividend history of companies, you can create a diversified portfolio of dividend stocks that can provide attractive long-term returns.

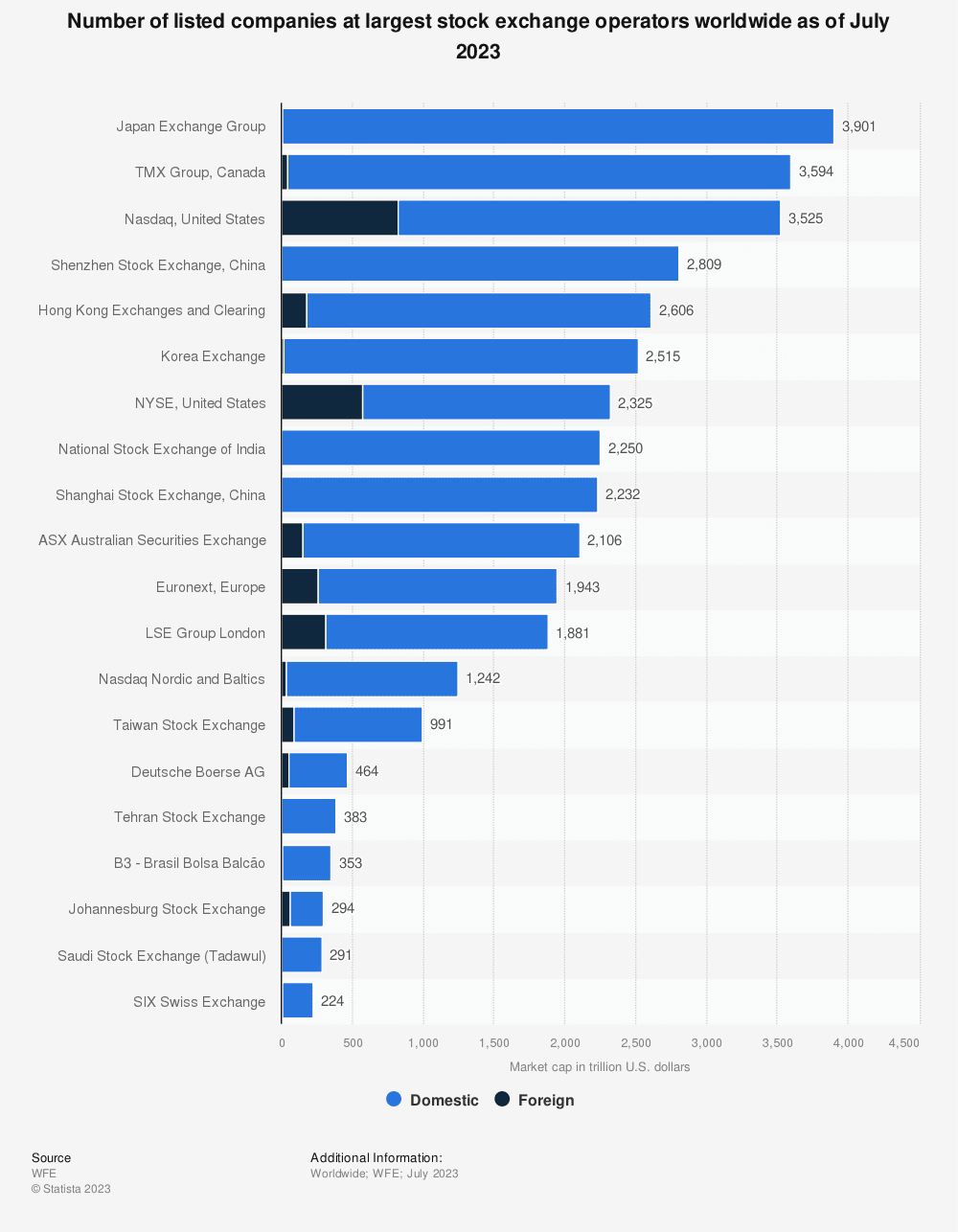

Here we have Number of listed companies at largest stock exchange operators worldwide as of July 2023

Risks of Dividend Investing

If you’re considering investing in dividend-paying stocks, it’s important to be aware of the potential risks involved. While dividend-paying stocks can be a great source of income, there are some factors that could negatively impact your investment.

Dividend Cuts and Suspensions

One of the biggest risks of dividend investing is the possibility of a company cutting or suspending its dividend. This can happen for a variety of reasons, such as a decline in the company’s financial performance or a need to conserve cash.

When a company cuts or suspends its dividend, it can have a significant impact on the stock price. Investors may sell their shares, causing the stock price to drop, and this can result in a loss for those who hold the stock.

To mitigate this risk, it’s important to research the company’s financial health and dividend history before investing. Look for companies with a consistent track record of paying dividends and a strong financial position.

Market Volatility

Another risk of dividend investing is market volatility. The stock market can be unpredictable, and even the most stable companies can experience fluctuations in their stock price.

During times of market volatility, dividend-paying stocks may be more volatile than non-dividend-paying stocks. This is because investors may sell their shares in search of safer investments, causing the price of the stock to drop.

To protect yourself against market volatility, it’s important to diversify your portfolio. This means investing in a variety of stocks, bonds, and other assets to spread out your risk.

Overall, dividend investing can be a great way to generate income, but it’s important to be aware of the potential risks involved. By doing your research, diversifying your portfolio, and staying up-to-date on market trends, you can help protect your investments and achieve your financial goals.

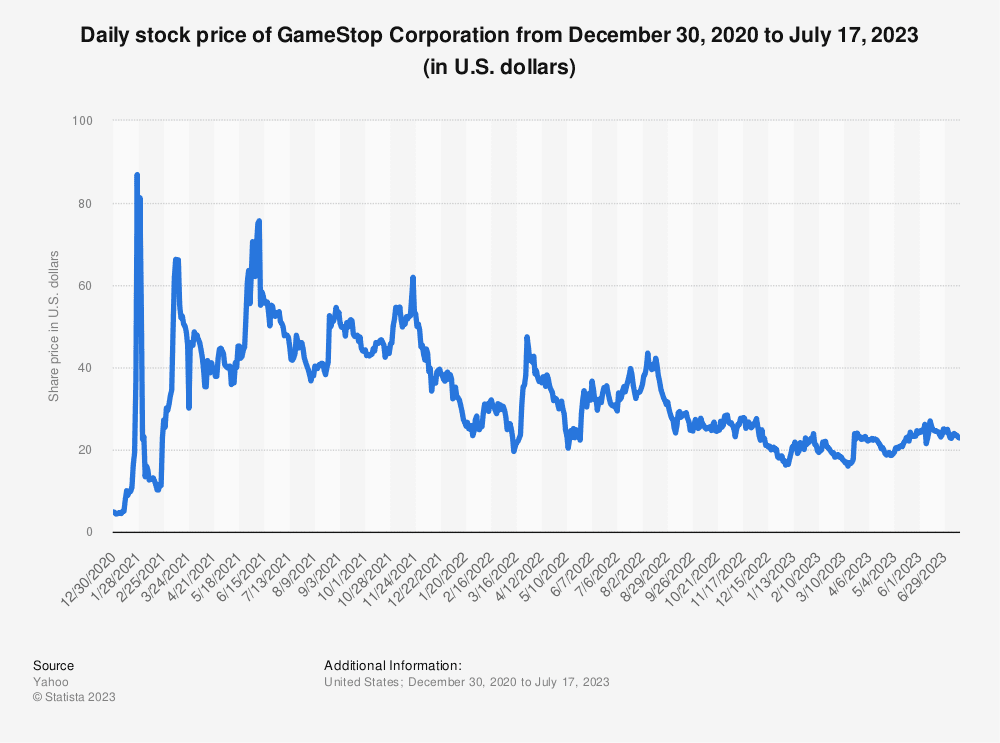

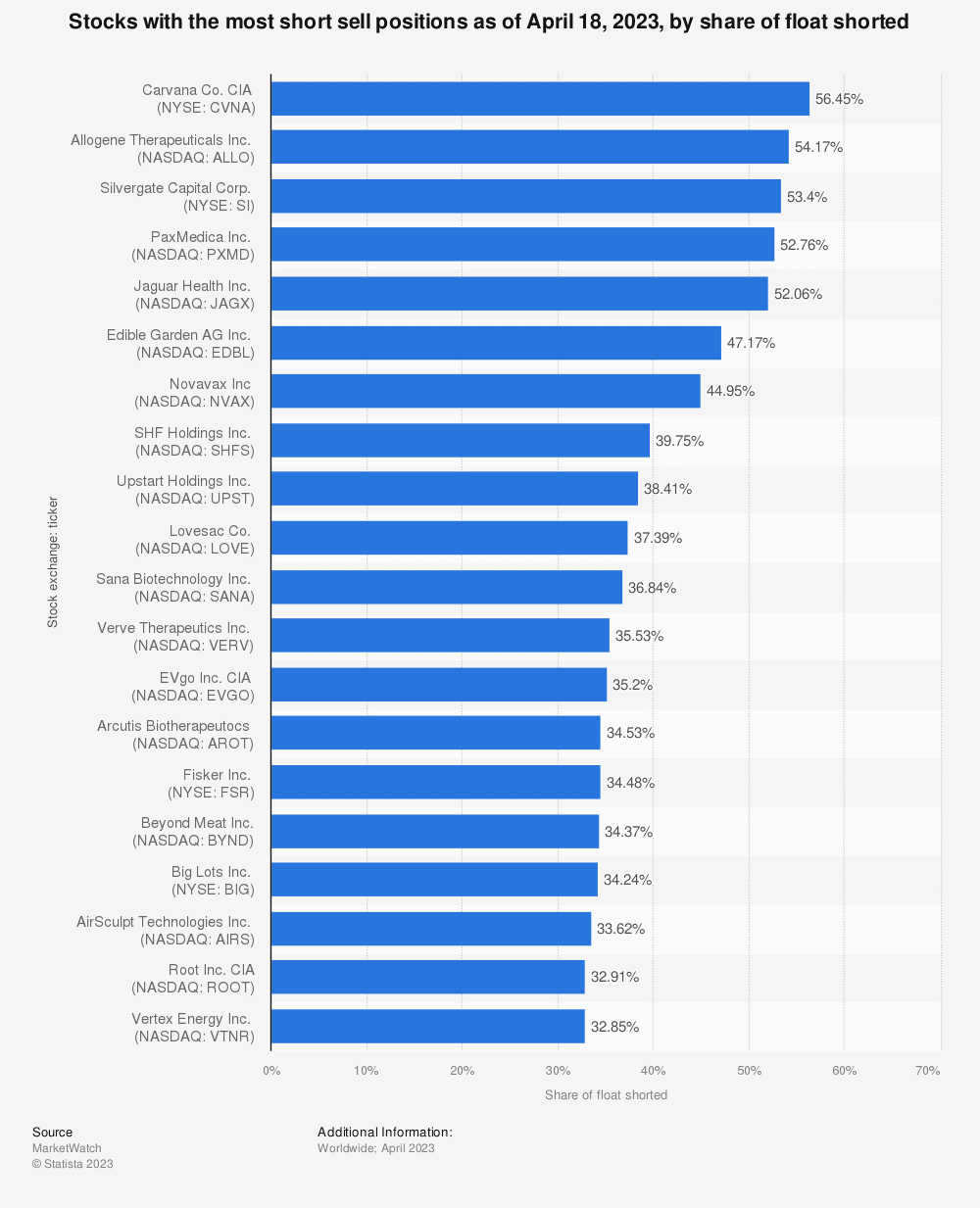

As of March 22, 2023, the stock that many people were betting against (thinking its price would go down) was Carvana, an American online used-car seller. About 56.45 percent of their total available shares were being bet against. This is different from what happened in mid-January 2021 when GameStop, a video game seller, had an unusual situation. At that time, a lot more shares (121.07 percent) were being bet against than were actually available for people to buy. This means investors borrowed more shares than there were to trade.

Because of this, regular people who invest in stocks (retail investors) started a movement to increase GameStop’s stock price. This caused big losses for the investors who had to buy back their borrowed shares.

Here we have Daily stock price of GameStop Corporation from December 30, 2020 to July 17, 2023 (in U.S. dollars)

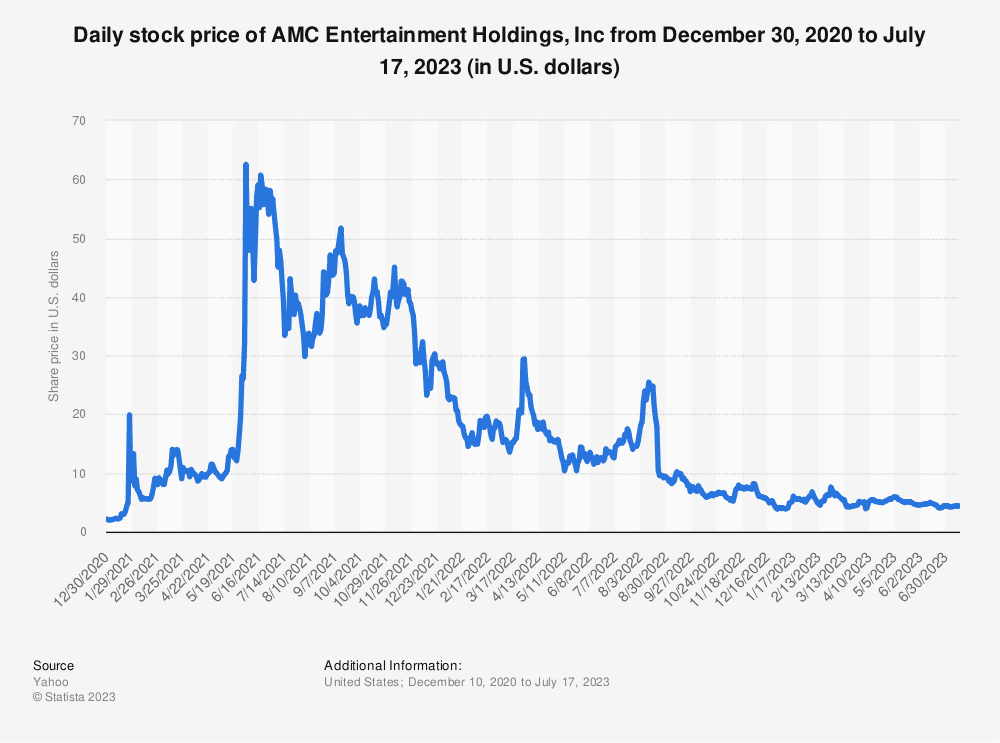

Around the same time, there was also a less successful effort on social media to influence the stock prices of AMC, a cinema company, and silver.

Here we have Daily stock price of AMC Entertainment Holdings, Inc from December 30, 2020 to July 17, 2023

Tax Implications of Dividend Income

When you receive dividends from your investments, you may be subject to tax. The amount of tax you pay on your dividend income depends on your tax bracket.

Tax Rates

In the UK, there are three tax brackets: basic rate, higher rate, and additional rate. The tax rate you pay on your dividend income depends on your tax bracket.

- Basic rate taxpayers pay a 7.5% tax on dividends above the dividend allowance.

- Higher rate taxpayers pay a 32.5% tax on dividends above the dividend allowance.

- Additional rate taxpayers pay a 38.1% tax on dividends above the dividend allowance.

Dividend Allowance

The dividend allowance is the amount of dividend income you can receive tax-free each year. The dividend allowance for the 2023-24 tax year is £1,000. This means you won’t need to pay any tax on the first £1,000 of dividend income you receive.

Self-Assessment Tax Return

If you receive more than £10,000 in dividends in a tax year, you will need to fill in a self-assessment tax return. This is because the tax on your dividend income is not automatically deducted by the company paying the dividends.

Tax-Efficient Investments

If you want to reduce the amount of tax you pay on your dividend income, you can consider investing in tax-efficient investments such as ISAs or pensions. These investments allow you to receive dividends tax-free or with a reduced tax liability.

It’s important to keep in mind that tax rules and regulations can change over time. It’s always a good idea to consult with a professional financial advisor or accountant to ensure you understand the tax implications of your investment decisions.

Here we have Stocks with the most short sell positions as of April 18, 2023, by share of float shorted

Building a Diversified Dividend Portfolio

When building a dividend portfolio, diversification is key to managing risk and maximizing returns. A diversified portfolio is one that contains stocks from different sectors and geographies. This helps to ensure that if one sector or region experiences a downturn, the entire portfolio will not suffer. Here are some ways to build a diversified dividend portfolio:

Sector Diversification

One way to diversify your dividend portfolio is by investing in stocks from different sectors. This can help to spread your risk and ensure that your portfolio is not overly exposed to any one sector. Some sectors that are known for paying high dividends include:

- Utilities

- Consumer staples

- Real estate

- Energy

- Healthcare

It’s important to note that while these sectors may offer high dividends, they may also be more volatile than other sectors. It’s important to do your research and understand the risks associated with each sector before investing.

Geographic Diversification

Another way to diversify your dividend portfolio is by investing in stocks from different regions. This can help to spread your risk and ensure that your portfolio is not overly exposed to any one country or region. Some regions that are known for paying high dividends include:

- Europe

- Asia

- North America

- Australia

It’s important to note that while these regions may offer high dividends, they may also be more volatile than other regions. It’s important to do your research and understand the risks associated with each region before investing.

In summary, building a diversified dividend portfolio is key to managing risk and maximizing returns. By diversifying your portfolio across different sectors and regions, you can help to ensure that your portfolio is not overly exposed to any one sector or region.

In 2023, 61 percent of grown-ups in the United States put their money into the stock market. This number has stayed about the same for the past few years and is not as high as it was before the Great Recession. Back in 2007, the percentage of people investing in stocks reached its highest point at 65 percent.

FAQs: Stocks That Pay Dividends

What criteria determine the best dividend-paying stocks for retirement portfolios?

When selecting dividend-paying stocks for retirement portfolios, it is important to consider factors such as the company’s financial stability, dividend history, and overall performance. Companies that have a long history of paying dividends and have consistently increased their payouts over time are often considered to be the best choices for retirement portfolios.

How can investors identify the highest yielding monthly dividend stocks?

Investors can identify the highest yielding monthly dividend stocks by looking at the yield percentage, which is the annual dividend payment divided by the stock price. It is important to note that extremely high yields may be unsustainable and could be a red flag. Investors should also look at the company’s financials and dividend history to ensure that the company is financially stable and has a history of paying dividends.

What are the characteristics of the safest high dividend-paying stocks?

The safest high dividend-paying stocks are typically those of companies that have a long history of paying dividends and have a strong financial position. These companies tend to have consistent earnings and cash flow, which helps to ensure that they can continue to pay dividends even during economic downturns.

Which companies have a history of paying the highest dividends?

Some of the companies that have a history of paying the highest dividends include Royal Dutch Shell, BP, and GlaxoSmithKline. These companies have a long history of paying dividends and have consistently increased their payouts over time.

How do high dividend ETFs compare to individual dividend-paying stocks?

High dividend ETFs offer investors a way to invest in a diversified portfolio of dividend-paying stocks. This can help to reduce risk and provide a more stable source of income. However, investors should be aware that high dividend ETFs may have higher fees than individual dividend-paying stocks.

What factors should be considered when choosing the best UK dividend stocks?

When choosing the best UK dividend stocks, investors should consider factors such as the company’s financial stability, dividend history, and overall performance. It is also important to consider the current economic climate and any potential risks or challenges that the company may face in the future.