Revolut: The Future of Banking

As technology is upgrading by leaps and bounds, the banking industry has its fair share in technology. Many start-ups have launched digital banking to make it easy to create accounts and receive money internationally. Revolut is also a similar banking platform.

The banking apps helped many people globally to send and receive international payments. As time passes, these apps and systems become the core of digital banking apps. To learn more about such platforms, read the article thoroughly.

What is Revolut?

Nikolay Storonsky founded Revolut in 2015. The aim was to provide mobile and online banking at a minimum fee than conventional banks. The banking app allows worldwide transfers and expenditures.

Revolut offers a prepaid card for its users, which can be topped up by bank transfers or debit/credit cards. The users can send and receive payments on the go. Moreover, one can send payment requests via the Revolut application too.

How much can I Withdraw from an ATM?

If an individual holds a free account, the monthly withdrawal cap is £200. However, premium account holders benefit from a higher limit, i.e., £400. For metal account holders, the limit goes up to £600 per month. But, if the limit is reached, a 2% fee per transaction is applicable.

Revolut Banking Features

While Revolut is a partial-blown bank as we speak, it, however, works similarly in some aspects or even better than conventional banks. Some of the features of Revolut are discussed below.

- Categorised transaction history (e.g., shopping, restaurants).

- Categories can set monthly budgets and goals.

- Sending money is done in an instant. Above all, you can request money transfers within the app.

- The smart savings option helps you monitor how much you’ve spent throughout the month and stores the savings difference accordingly.

- Direct debits are currently supported within Europe only.

- Setting up Apple Pay and Google Pay is possible, depending on your region.

- 3D Secure online payment method is available.

- Revolut also offers interest on your monthly savings within the card or app.

Charges on Transactions by Revolut

Account Opening

There is no fee for signing up with Revolut. The company also does not charge a monthly or yearly maintenance fee.

Card

Having your hands on a card in a free account costs £4.99. The charges are the delivery charges to your address. The card delivery is free for premium account holders.

ATM Transactions

Withdrawal of money from any ATM around the globe is free for up to £200 in free accounts, whereas the limits are different for premium accounts. You are charged 2% of the transaction fee once the limit cap ends.

Transfer Fee

If you transfer money via wire transfers, it is free for any international bank. Transfer in the same currency is also free. But if you use SWIFT transfer, you are charged accordingly.

Currency Exchange Fee

Revolut offers competitive market rates with minor differences in buying and selling rates during the weekdays. The rates are competitive whether you do an international transfer or an ATM transaction.

It is free for the first £1000 transfers and withdrawals during weekdays. On weekends, exchange rates are fixed and include a markup in free and premium accounts.

Top-up fee

Everyone wishes to have a free transaction, whether you top-up your account or do a transfer. Therefore, when you top-up your Revolut account, the trades are free.

Types of Revolut Cards UK

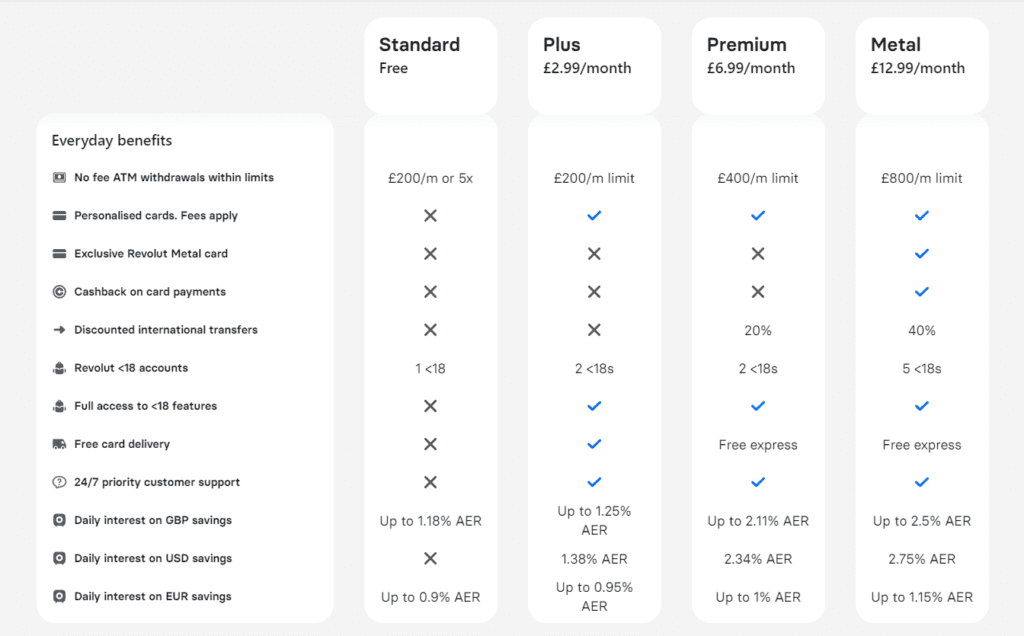

Revolut offers four types of cards. The cards depend on your plans, such as Standard, Plus, Premium, and Metal. Each card offers its specific benefits and features, which are discussed below.

Standard Revolut Card UK

Standard cards are the basic cards that Revolut has to offer. The card has no monthly fee.

Plus Revolut Card UK

Plus cards have a monthly fee of £2.99. The card offers extra features, such as cashback on Internet banking and purchases. The services are currently not available in the US.

Premium Revolut Card UK

Premium cards cost you £5.99 per month. The card offers a broader range of premium offers, such as travel and mobile phone insurance.

Metal Revolut Card UK

Metal cards cost £12.99 monthly. The card, therefore, offers high-end features. The features include access to airport lounges and concierge services.

Some Features of Revolut Card UK

- Revolut cards are accepted globally for around 3 million locations. The company waives the transaction fee for ATMs.

- No charges on transactions, ATM withdrawals, even at foreign locations; this is a pro benefit to avoid hefty charges of conventional banks.

- Real-time transactions prevent the settlement from occurring after your foreign trips on vacations and business.

- The card is available as a VISA and MasterCard; therefore, it can replace many travel cards.

- In case of any loss or theft of your card, the replacement comes without any charges. All you have to do is to report Revolut to lock your card before it is misused.

Revolut Business App

The Revolut business app is a customised setup to help save time and money for a small business. One can customise the features as per your business needs. The app allows you to accept payments via debit/credit cards or bank transfers.

The app also offers multiple security features, which include secured backup and fraud protection services. It ensures the business the safety of their data and finances. The app is free and has no transaction charges.

Revolut Login

Before you begin the Revolut login process, you must sign up to create an account. You go to the website to sign up for an account. Once you’ve registered, one can prompt Revolut login easily within seconds.

Revolut Reviews

Revolut has been ranked 4.3 stars out of 5 online. We’ve compiled some reviews below to help you save time and energy.

Pros and Cons

| PROS | CONS |

| Top-ups available in several countries | Revolut can put accounts on hold for security purposes |

| No physical bank despite holding banking licenses | No physical bank despite holding banking licences |

| Premium subscriptions have more perks | Customer support is mediocre |

Summary

Revolut is gaining the potential market in digital banking by improving its proposition. It works daily to provide analytics on your expenses and savings every month. It has taken the market by waiving the transaction and ATM fees to a specific cap limit.

One thing to keep in mind is that Revolut is not licensed in the UK, so the customers’ money is not protected by FSCS. One can avoid mishaps by only topping the cards up only when required. All in all, it is a great way to carry money internationally. Visit somquest to learn more.