Residual Income Formula for Affiliate Marketing Passive Income

Are you interested in earning passive income through affiliate marketing? If so, understanding the concept of residual income is crucial. Residual income is the income that continues to be generated even after the initial work has been completed. In the context of affiliate marketing, residual income is the income earned from the sales made by the affiliates you have recruited. Many individuals are seeking opportunities to earn affiliate marketing residual income.

The residual income formula is a powerful tool that can help you calculate the amount of money you can earn from your affiliate marketing efforts. It takes into account the initial investment, the cost of goods sold, and the expenses incurred to generate the sales. By using this formula, you can determine the amount of residual income you can expect to earn over a certain period of time.

In this article, we will explain the concept of residual income in detail and how it applies to affiliate marketing. We will also discuss the residual income formula and how you can use it to estimate your potential earnings. Whether you are new to affiliate marketing or a seasoned pro, understanding residual income is essential to building a successful and sustainable passive income stream.

Table of Contents

Residual Income Explained

Residual income is a type of income that continues to be generated after the initial work has been done. It is a form of passive income that can be earned by individuals who have invested their time, effort and resources in a particular project or business. The concept of residual income is based on the idea that you can earn money without having to actively work for it.

In affiliate marketing, residual income is earned by promoting products or services to others. This can be done through a website, blog or social media platform. When a customer clicks on an affiliate link and makes a purchase, the affiliate earns a commission. The commission is usually a percentage of the sale and can be earned repeatedly as long as the customer continues to make purchases.

Residual Income in Personal Finance

Residual income can be an important part of personal finance. It is a way to earn money without having to actively work for it. This can be particularly useful for individuals who want to earn extra income while still working a full-time job or for those who want to retire early.

In personal finance, residual income can be used to calculate a person’s net worth. It is calculated by subtracting all expenses from the total income earned. This includes both active and passive income. The residual income formula can be used to determine how much money is left over after all expenses are paid.

Residual income can also be used to evaluate investments. It is a way to determine the potential return on investment over time. By calculating the residual income of an investment, you can determine whether it is a good investment opportunity.

Residual Income Formula

If you’re looking for a way to generate passive income, affiliate marketing can be a great option. One of the key concepts in affiliate marketing is residual income, which is the income you receive on an ongoing basis for work that you’ve already done. In this section, we’ll explore the residual income formula and how it can be used in valuation.

Calculating Residual Income

The residual income formula is a simple one:

Residual Income = Net Income – (Cost of Capital x Equity)

Where Net Income is the income generated from the investment, Cost of Capital is the minimum rate of return required by investors, and Equity is the amount of capital invested.

For example, let’s say you’re an affiliate marketer promoting a product that generates £10,000 in net income each year. The cost of capital is 10%, and you’ve invested £50,000 in the product.

Using the formula, we can calculate your residual income as follows:

Residual Income = £10,000 – (0.10 x £50,000) = £5,000

This means that you’ll receive £5,000 in residual income each year for as long as you continue to promote the product.

Residual Income Valuation

The residual income formula can also be used in valuation. By calculating the residual income of a company, you can determine its intrinsic value.

To do this, you’ll need to estimate the company’s future net income and determine its cost of capital. Once you have these figures, you can use the residual income formula to calculate the company’s residual income.

If the residual income is positive, the company is generating more income than its cost of capital, which means it has value. If the residual income is negative, the company is generating less income than its cost of capital, which means it’s not worth investing in.

In conclusion, the residual income formula is a powerful tool for affiliate marketers and investors alike. By understanding how to calculate residual income and apply it in valuation, you can make informed decisions about your investments and generate passive income for years to come.

Affiliate Marketing as a Source of Residual Income

Affiliate marketing is a type of performance-based marketing where a business rewards an affiliate for each customer brought in through their marketing efforts. Affiliates promote a product or service through various channels, such as social media, blogs, or email marketing, and earn a commission for each sale made through their unique affiliate link.

The commission structure for affiliate marketing can vary depending on the program and product being promoted. Some programs offer a one-time commission for each sale, while others offer recurring commissions for as long as the customer remains subscribed to the product or service.

Earning Residual Income Through Affiliate Marketing

Affiliate marketing can be a great source of residual income, as long as you are promoting products or services that have a recurring revenue model. This means that the customer pays a subscription fee or makes regular purchases, providing you with a commission for each transaction.

One example of a product that can provide residual income through affiliate marketing is a subscription-based software service. As long as the customer continues to use the software and pay their subscription fee, the affiliate can continue to earn a commission on each payment.

Another example is a membership-based website or online course. As long as the customer remains a member and pays their monthly fee, the affiliate can continue to earn a commission on each payment.

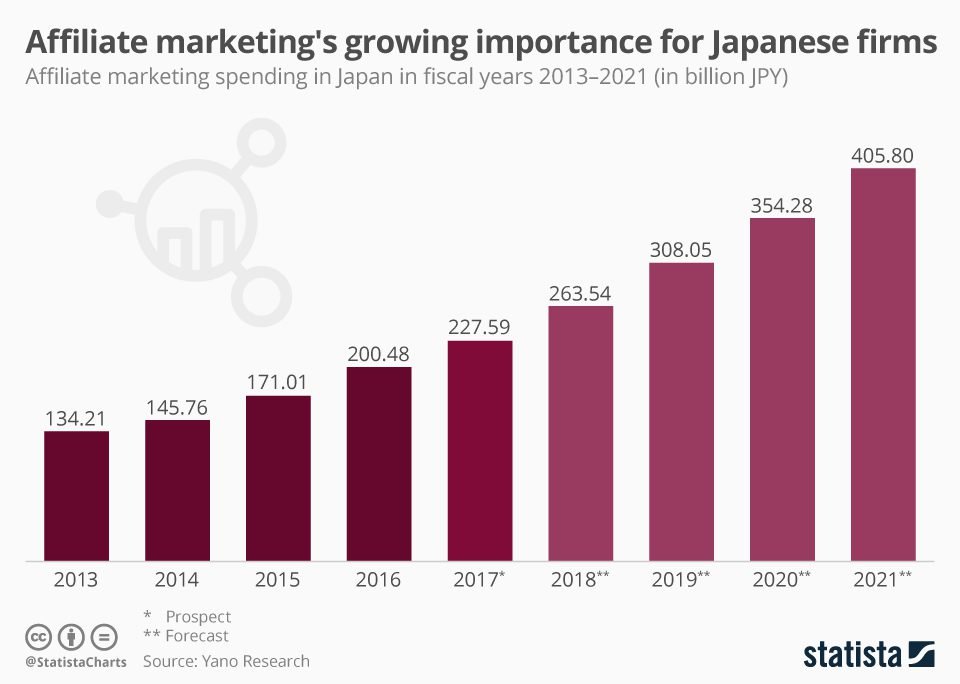

Japanese companies have been putting more money into affiliate marketing lately. Every year, the market in Japan has been growing by about 15%. One reason for this growth is that it’s easier for Japanese consumers to click on affiliate links using their smartphones or tablets.

Overall, affiliate marketing can be a great way to earn residual income, as long as you are promoting products or services with a recurring revenue model. By promoting these products through various channels and building a strong relationship with your audience, you can continue to earn commissions for as long as the customer remains subscribed or continues to make purchases.

Affiliate Marketing Passive Income

Passive income is income that is earned without actively working for it. While affiliate marketing can provide a source of passive income, it is important to note that it still requires effort and time to build a successful affiliate marketing business.

To earn passive income through affiliate marketing, you need to create a system that can generate sales and commissions without your constant input. This can be achieved through automation, such as using email marketing campaigns or setting up a sales funnel.

Affiliate Residual Income

Affiliate residual income is the income earned through recurring commissions from products or services that have a recurring revenue model. By promoting these products through various channels and building a strong relationship with your audience, you can continue to earn commissions for as long as the customer remains subscribed or continues to make purchases.

In 2022, affiliate marketing in Japan was worth about 385 billion yen. Because more people are shopping online and using e-commerce, it’s predicted to grow to around 564 billion yen by 2026.

Maximising Residual Income

As an affiliate marketer, maximising your residual income is key to achieving long-term financial success. Below are some strategies you can use to sustain your earnings and diversify your income streams.

Strategies for Sustainable Earnings

One of the best ways to maximise your residual income is to focus on sustainable earnings. This means promoting products and services that offer recurring commissions, such as subscription-based services, rather than one-off sales. By doing this, you can earn commission on a regular basis, even if you don’t actively promote the product or service.

Another strategy is to focus on high-ticket items. These are products or services that have a high price point and offer a large commission. While it may take longer to make a sale, the higher commission can make it worth your while.

Diversification of Income Streams

Diversifying your income streams is another key strategy for maximising your residual income. This means promoting products and services across different niches and platforms. By doing this, you can reduce your reliance on a single product or service, and spread your income across multiple sources.

One way to diversify your income streams is to promote products and services across different affiliate networks. This will give you access to a wider range of products and services, and increase your earning potential.

Another way to diversify your income streams is to create your own products or services. This could be an eBook, course, or coaching service. By doing this, you can earn 100% of the profits, rather than just a commission.

In summary, maximising your residual income as an affiliate marketer requires a focus on sustainable earnings and diversification of income streams. By using these strategies, you can build a long-term, sustainable income that will continue to grow over time.

Challenges and Considerations

Common Pitfalls and How to Avoid Them

When it comes to affiliate marketing, there are several common pitfalls that can hinder your success in achieving residual income. One of the biggest mistakes that affiliates make is promoting products that they are not passionate about or do not align with their audience’s interests. This can lead to low conversion rates and ultimately, lower residual income.

Another pitfall is relying solely on one affiliate program or product. This can be risky as if the program or product loses popularity or becomes outdated, your residual income will suffer. It’s important to diversify your affiliate partnerships and promote a range of products that are relevant to your audience.

Additionally, it’s crucial to disclose your affiliate relationship with your audience. This not only builds trust but is also required by law. Failure to disclose your relationship can lead to legal issues and damage your reputation as an affiliate marketer.

To avoid these common pitfalls, it’s important to choose affiliate products that align with your interests and your audience’s needs. Diversify your partnerships and disclose your affiliate relationship to build trust and maintain a positive reputation.

Long-term Planning for Residual Income

While affiliate marketing can provide a source of residual income, it’s important to have a long-term plan in place. As an affiliate marketer, you should aim to build a loyal audience that trusts your recommendations. This can be achieved by creating valuable content that educates and informs your audience.

It’s also important to stay up-to-date with industry trends and changes in your niche. This will ensure that you are promoting relevant products and services that are in demand. Additionally, you should regularly evaluate your affiliate partnerships to ensure that they are still profitable and align with your audience’s interests.

Finally, it’s important to have a backup plan in case your primary source of residual income falls through. This can include diversifying your income streams or having a contingency plan in place in case of unforeseen circumstances.

In summary, having a long-term plan and a diversified approach to affiliate marketing can help ensure a sustainable source of residual income. By avoiding common pitfalls and staying up-to-date with industry trends, you can build a loyal audience and maintain a positive reputation as an affiliate marketer.

Frequently Asked Questions

What distinguishes residual income from passive income?

Residual income is a type of passive income that continues to generate revenue even after the initial work has been completed. This type of income is earned through ongoing work or investments, rather than through a one-time transaction. Passive income, on the other hand, is money earned through investments or other activities that require little to no ongoing effort.

Could you provide examples of residual income?

Some examples of residual income include rental income, royalties from books or music, and affiliate marketing. In each of these cases, the income continues to be generated long after the initial work has been completed.

How is residual income utilised within sales contexts?

Residual income can be utilised in a sales context by offering commission-based compensation to salespeople. Rather than paying a one-time commission for a sale, salespeople can earn a percentage of the ongoing revenue generated by that sale. This incentivises salespeople to continue generating revenue for the company, even after the initial sale has been made.

What methods are used to calculate residual income?

There are several methods used to calculate residual income, including the net present value (NPV) method and the discounted cash flow (DCF) method. These methods take into account the time value of money and the cost of capital, and are used to determine the present value of future residual income streams.

What are some viable ideas for generating residual income?

Some viable ideas for generating residual income include investing in rental properties, creating and selling digital products, and affiliate marketing. These methods require an initial investment of time and/or money, but can generate ongoing income for years to come.

In accounting, how is residual income characterised?

In accounting, residual income is characterised as the amount of income generated by an investment or business after all costs and expenses have been deducted. This amount is considered to be the true profit of the investment or business, as it takes into account the cost of capital and the time value of money.