Whatever you earn through a 9-to-5 job may be sufficient for you to live a simple life. But is it what you want? Would you not want a more comfortable life filled with excitement and financial freedom? So, if this thought makes you feel a need to increase your current income, then you must know Trending Ideas on how to make passive income online in 2024.

One of the best ways to become wealthy is to generate passive income streams. This way, you can earn extra money with a paycheck from your primary job. Rather than losing your purchasing power due to a continuous rise in inflation, making additional income would let you achieve your dreams.

- What is passive income?

- 13 trending Ideas on how to make Passive Income Online in 2022

- 1. A dropshipping store

- 2. Create a blog

- 3. A print-on-demand store

- 4. Create a mobile application

- 5. Affiliate marketing

- 6. Make your own Youtube channel.

- 7. Create and sell digital products

- 8. Sell courses online

- 9. Sell NFTs

- 10. Buy and flip websites.

- 11. Write an e-book

- 12. P2P lending

- 13. Use passive income apps.

- Other ways to make passive income

- Own dividend stocks

- Rental income

- Rent out your unused spaces or assets

- How to make passive income with no money?

- 5 basic factors in determining the best passive income source

- Conclusion: How to make passive income

Moreover, this extra security will support you when you want to take a break from work or when you get unemployed. Therefore, if you cannot save enough money from your current source of income, you must look for other ways to increase your cash flow.

Now that you want to proceed in making this plan successful but what you do not know is how to make it happen? This article will guide you through the possible ways to make passive income, how to make passive income with no money, and how to choose the right income stream.

What is passive income?

Passive income is the money earned regularly through some business or investment without active participation. It does not require your continuous time and effort. However, it demands most of the work upfront, and you will do little labor along the way to keep the money flowing.

For example, You may require to keep your products updated and maintain your assets to earn some extra dollars.

Here, your time is not equal to money; you can count on your initial investment in your skills, money, time, dedication, and energy and enjoy the perks of it for the longest time. So, I have come up with a list of passive income ideas, including various categories for you to pick and fit in. I will explain this later because first, you need to understand what does not fall into the income that is earned passively:

- Your primary job through which you earn by actively participating in it.

- The second job requires you to show up regularly, e.g., freelancing, in which you must put your hard work to get the job done consistently.

- Non-productive assets as they do not earn you any interest or dividend, e.g. a car that is worth a lot of money but is unlikely to generate any income unless you rent it out.

13 trending Ideas on how to make Passive Income Online in 2024

1. A dropshipping store

You can set up your dropshipping store. It is growing and is one of the best passive income sources. You can easily assess the trending products from the online marketplaces (e.g., Amazon, AliExpress, Alibaba) and add them to your online store. Moreover, it allows you to take up items from several dropshipping niches like beauty, fashion, home décor, etc.

With dropshipping, you can earn controlled margins with a wise choice of products, ensuring high quality. You can also connect with wholesalers ready to ship the products to your customers directly. Shopify is a reputable online e-commerce platform to start your store.

2. Create a blog

You can build not one but several streams of passive earning by creating an awesome blog. It is one of the best options for beginners especially. Blogging helps earn through sponsored posts, banner advertising, courses, affiliate links, products, etc.

You must create engaging and interesting content to motivate your visitors to build a loyal following. Your unique content will thereby draw more sponsors with time.

3. A print-on-demand store

If you are a good artist and a graphic designer, then you can go for creating a print-on-demand store online. It will allow you to work in your area of interest and monetize your creativity. It involves selling custom graphics on products such as clothing, mugs, phone cases, bags, etc.

It is a dropshipping practice where you do not need to deal with inventory management and shipping. Instead, the suppliers will manage the printing job and order fulfillment process, which will take place once your product is sold. Your creative and winning designs will consequently boost sales with time.

4. Create a mobile application

Creating apps that cater to the audience needing the solution to their hard-to-do jobs is an incredible idea for generating additional revenue. Your app may fall into categories like education, social media, lifestyle, entertainment, productivity, or games.

You can either earn by charging a fee for your app or monetize with ads by making it free for the users. Once it gains popularity, you can add incremental features to keep it relevant.

5. Affiliate marketing

If you are still confused about how to make passive income online? Then take a step towards becoming an affiliate marketer as it is easier, emerging, and a low-risk business idea. With little or no money, affiliate marketing provides you with an excellent opportunity to earn passively.

It involves promoting a third party’s product or service. You get the commission every time a product is sold through your referral link. To do this, you must own a website or a blog or be a social media influencer so that you may add a link to the product or service on your site or social media account.

6. Make your own Youtube channel.

A successful Youtube channel brings you a decent amount of passive income but involves steady growth and requires commitment. You need to initially put in a lot of hard work and wait patiently for it to connect with the audience. However, appealing and well-researched content, good video making, editing, and marketing will eventually enable you to ripe the benefits.

More clicks and visitors will draw more sponsorships, ad income, affiliate sales, and branded integrations. Hence, these will increase your earnings passively.

7. Create and sell digital products

You can create valuable digital products and start selling them through your blog, e-commerce store, or even social media pages. These are software-enabled products or services aimed at providing a solution to a problem or achieving something. They include tutorials, guides, workbooks, audiobooks, website templates, etc.

They offer high-profit margins as there is no inventory or storage cost involved. You can repeatedly keep on selling these products once created.

8. Sell courses online

It is an excellent income stream if you are wondering how to make passive income online? You can create audio and video courses online and keep the cash rolling in by selling your products. Udemy, Coursera, and SkillShare are the best online learning platforms for distributing such content. However, selling these courses through your own website will make them more lucrative.

You can also consider using a “freemium model” to create a customer base. It allows you to sell free content and charge per more detailed information requirements. The content you sell at first will show your skill and expertise; thus, it is significant in making customers’ minds for seeking information further.

9. Sell NFTs

NFTs are non-fungible assets that are created using similar technology as cryptocurrencies. You can make NFTs of rare digital assets, including video game collections, custom paintings, memes, GIFs, pictures, or even tweets. Its NFT value depends on its uniqueness.

Once you create an NFT, the next step is to start minting by opening an account and following a step-by-step process. OpenSea, NBA Top Shot, and Axie are some of the best NFT marketplaces where you can publish your NFTs and make them purchasable. However, it charges a gas fee which is a bit higher. Therefore, this business idea requires you to invest significant time and money.

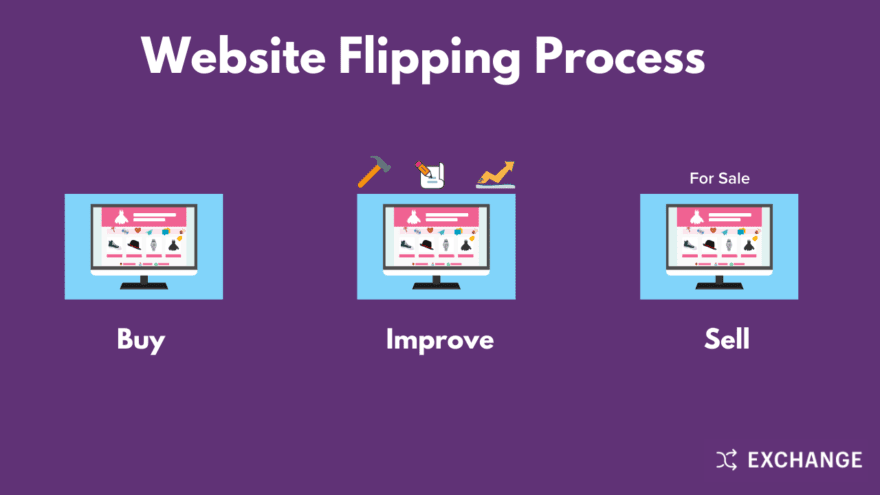

10. Buy and flip websites.

You can buy an already-running website, improve its SEO optimization or traffic and monetize it. But, first, you need to generate some revenue to prove its potential, and then you can sell it for profit. Indeed, you can crack a good deal with someone looking to buy a ready-made e-commerce website. Then, you can offer your website for sale on Shopify’s Exchange Marketplace.

11. Write an e-book

If you have a piece of great knowledge of certain topics that are not widely available but many readers need, you can surely step into writing an e-book. The positive thing is that it requires little monetary investment due to the low publishing cost. You can even reach millions of people through Amazon, getting its worldwide distribution. However, it primarily requires your time and expertise to excel.

You can also take help from book writers or editors through platforms like Fiverr and Upwork. In addition, you can test different titles and price points to optimize sale revenue. So, the page reads, and Kindle sales accumulate for the passive income of most e-book writers.

12. P2P lending

If you have some extra cash you have not planned to spend soon, you can lend it to earn passive income. Peer-to-peer lending includes offering money to borrowers or small businesses through intermediary websites such as Prosper, LendingClub, for individuals, and Funding Circle or Worthy for small businesses with high borrowing limits.

You can earn through interest payments, usually around 5% to 6%. It is wise to lend smaller amounts over multiple loans if you want a diversified portfolio. It will also protect you from losing a huge amount of money in case of any unfortunate event. You must also check the borrower’s history to avoid the risk of default.

13. Use passive income apps.

You can download different passive income apps on your phones and start making money. They involve doing everyday activities such as downloading an app, playing games, shopping online, getting a refund in case of a price drop on the item you purchased or watching videos, etc. Examples may include Swagbucks, Capital One Shopping, Fundraise, etc.

Other ways to make passive income

Here are some more ways to make passive income. Let’s discover:

Watch this video, 5 Highest Floor Price NFT projects

Own dividend stocks

You can buy company stocks with high dividend yields for which you will receive quarterly payments out of their profits. The more share you own, the more you can earn.

Rental income

Investing in Real estate is the oldest way of making a passive income stream. You can purchase and rent out properties. However, it would help if you analyzed the associated financial risks to make it a profitable venture. You may also need to hire a manager to handle tenants and collect monthly rent. Nevertheless, REIT is an option you can still avail of if you have fewer funds.

Rent out your unused spaces or assets

You can rent a free room in your apartment, an empty garage, or a car. For this purpose, you can use several different platforms, such as Airbnb, Peerspace, Carvertise, etc.

How to make passive income with no money?

If you have short of funds or have no funds, you can still make passive income streams by investing your time and expertise. What you have to do is focus on the opportunities where you can outshine and start earning eventually by devoting:

- Your proficiency

It may include graphic designing, software coding, etc.

- Your hard work

It may include being an Instagram or social media influencer, affiliate marketer, etc.

5 basic factors in determining the best passive income source

The best passive income strategy that may work in your favor must be evaluated, keeping in mind the following factors:

- Your ability and interest in the area

- The capital you have to invest

- Total opportunity size

- The amount of time you will need to invest

- The potential to succeed.

Read my article: Top 5 Reasons Why Shopify Is The Best E-commerce Platform

Conclusion: How to make passive income

Passive income is highly significant in making your life easier and less stressful. You can travel more, help others, and take better care of yourself. When you start making income, new opportunities automatically come your way. With time, you can increase your secondary income streams and become more confident about your financial future.

It requires no less commitment than active income. Hence, you can opt for diverse strategies but cannot lose focus, ensuring their manageability when paired with one another. So, pull up your socks and get started.